Schreiben Sie uns Ihre Nachricht

Schreiben Sie uns Ihre Nachricht

Mergers & Acquisitions make sense as soon as a company wants to grow. A company acquisition is then an interesting possibility to enable this growth. After all, taking over a competitor can create new potential on the market, win new customers or benefit from existing know-how. The M&A process takes place in three phases. The phases are the preparation, transaction and integration phase. You can find out here exactly how these three phases work and which mistakes are often made in an M&A transaction.

M&A stands for the English term Merges & Acquisitions.

Central motives for Mergers & Acquisitions are:

During the preparation phase, the strategy, goals and core competencies of the implementing company must first be precisely identified. Existing strengths and weaknesses of the competition should be thought through and taken into account from the first beginning. On this basis, a potential candidate should then be derived. The screening of the market can begin. The preparation phase ends as soon as a potential candidate is found.

The transaction phase begins with the first contact. Sensitive informations are made available to a limited group of people right from the start. However, the participants of this so-called „clean team“ must sign a confidentiality agreement. Any received information may only be used to carry outthis project.

If both companies have an interest in working together, the detailed investigations andnegotiations will begin now. The detailed examination of the company (Due Diligence) is primarily intended to identify possible risks. These are mainly the following risks:

However, it is often not possible to identify all the risks involved. Therefore, it can be useful to take out a Warranty & Indemnity insurance(short W&I insurance).

In this context, it is also advisable to take out D&O insurance for executives.

Parallel to the Due Diligence, communication with the owners is also carried out. An agreement is reached on the following points:

Once an agreement has been reached, a contract regarding the merger or acquisition is drawn up in detail. The phase ends with the signing of a contract between the parties.

Unfortunately, companies often concentrate too much on the transaction phase. However, a successful integration phase is at least as important as the transaction phase itself. During the integration phase, the organizational and cultural organization of the two companies is the focus of attention. Products, processes and technologies as well as employees must be brought together. Without a successful integration, the corporate goals cannot be achieved.

Integration is successful when the change process is perceived as positive by all those who are involved. Only then are the fundamental conditions laid for generating economic success. Success factors of a good integration phase are:

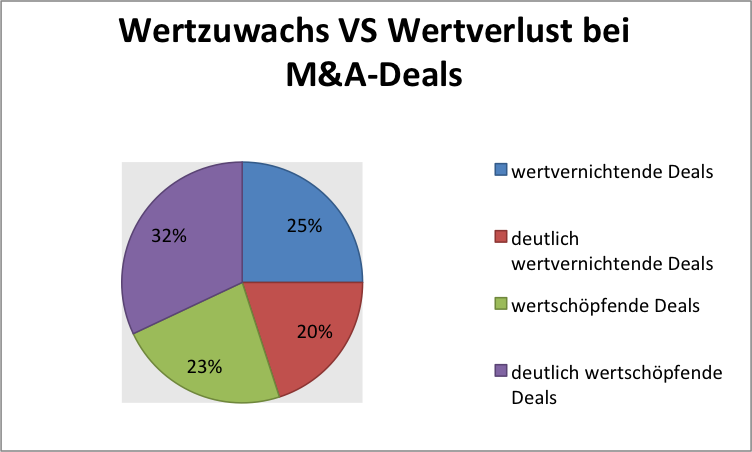

However, mergers and acquisitions are a challenge for every company. Failures of M&A processes are quite likely. After a merger, profitability is negative for approx. 45% of all companies. Although in recent years the failure rate has dropped from 90% to 45%, but the risk of failure is still quite high. Mistakes during the M&A process are the reason for this high negative rate. Already one or two mistakes can lead to failure, which cannot be corrected afterwards.

Fundamental errors are:

Due to the high potential for errors, it can therefore make sense to consult an expert during an M&A process. In this way, mistakes can be prevented and an increase in value is more likely to be achieved. Our subsidiary, STC Risk, offers such advice. The main focus here is on risk management. Further information on STC Risk can be found here: STC Risk Gmbh

Do you have any questions or would you also like some advice? The experts at STC will be happy to advise you .